nine Personal bank loan Benefits You should know

Unsecured loans would be the wade-in order to selection for meeting monetary goals and requirements. He is personal loans and don’t need people collateral. They are utilised for several aim instance tossing a grand matrimony, travel to a unique location, appointment unforeseen medical problems, or remodeling your residence in order to inform the looks.

Among the primary personal loan experts was their problem-totally free software process. Besides, a personal loan is actually much easier as you can also be pay it off more an occasion inside the wallet-amicable payments.

Just how do unsecured loans functions?

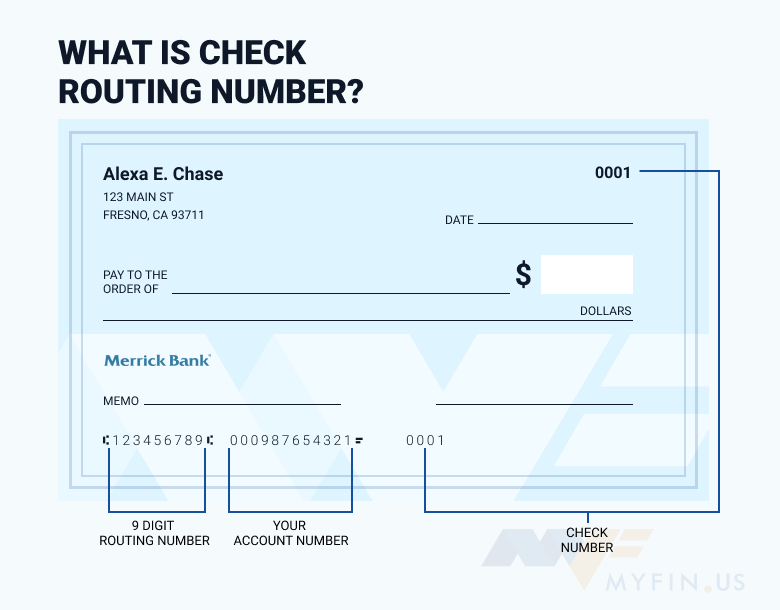

Personal loans are similar to almost every other finance. You could get in touch with a financial or financial institution to make an application for an equivalent. 2nd, fill in all the required data files indexed by the lender. The financial institution verifies what your provide to make it direct and you can true. It also inspections your own creditworthiness before making financing render. For those who undertake the offer, the financial institution transfers the borrowed funds amount to your money, and you will use it as per your own requirement.

The new debtor must pay the borrowed funds count inside the equated monthly installment payments (EMIs). The brand new repayment count is actually determined according to the loan amount, interest, and financing tenure.

5 reasons to score a personal bank loan

You ought to consider carefully your finances prior to taking for the financing. A personal bank loan facilitate finance a massive purchase which you don’t pay for upfront. They might be:

step 1. Household restoration: Signature loans are the best answer to buy updating their domestic or finishing expected fixes. dos. Crisis costs: A personal loan try a minimal-pricing choice to meet an urgent situation, including the funeral service regarding a family member or sudden scientific debts. step three. Moving costs: For those who usually do not have the money to possess a local or a great long-range move, you need to take a personal loan to pay for this new moving costs. 4. Travel expenditures: The expense of an average trips will most likely not require getting good unsecured loan. However,, let’s say you want to embark on a luxurious sail? A consumer loan comes in handy so you can complete such as for example travel aspirations. 5. Relationship can cost you: An unsecured loan lets possible partners to finance larger-solution things like the marriage planner, venue, brides and you can grooms top, etc.

Top 9 personal bank loan professionals

1. Hassle-100 % free papers One of the many unsecured loan benefits was limited records. For people who use online, brand new files is completely digital. You could publish the desired data along with your application form. The process is totally paperless. Some lenders also have a help having house file range. On the processes, banking institutions and you may financial institutions ask you to fill out proof of ages, address, bank account information, salary slips, taxation productivity, credit rating, etcetera.

dos. Short disbursal The newest disbursal of a home loan requires to step 3 in order to a month. Simultaneously, a consumer loan demands simply twenty four hours to help you 72 hours. Hence, they are top monetary unit to possess conference immediate cash otherwise percentage criteria. not, you need to meet with the qualifications criteria and have now an excellent credit get to get your mortgage paid rapidly.

3. No collateral needed Unsecured loans was personal loans. Ergo, you certainly do not need to include people collateral given that defense to own standard otherwise low-payment out of dues at the stop. This feature regarding personal loans means they are accessible to group that have a typical revenue stream and you may an excellent credit score.

cuatro. Help with debt consolidation reduction Some other important consumer loan work for is its ability to obvious expenses. For those who have debts such as for instance secured finance otherwise highest-attract playing cards, you can use the personal loan to clear the fresh expenses and you will dump obligations from your own portfolio. The attention cost into the unsecured loans try less than with the borrowing from the bank notes. So, you can utilize the reduced-notice financial product to repay high-desire personal debt.