On this page, we are going to identify exactly how USDA finance works

What does people realtor noted on RealEstateAgent take pleasure in a great deal more at the homeowners? Its independency and their transparency in terms of examining the various sorts of fund that are available to them. In fact, Point 502 Single-Family members Rural Housing Financing may have two variations. The original a person is new guaranteed USDA mortgage. The next a person is this new lead USDA loan. You should make this huge difference right away so that you can look at yourself most readily useful.

These types of mortgage is meant to generate casing less costly for many people exactly who wouldn’t brain residing in a rural area. Such as this, capable revive otherwise continue alive agreements that if you don’t may have turned into ghost places. Along with, driving shouldn’t be difficulty often.

The major advantage of a good USDA financing is that this has 100% resource. In other words, homeowners don’t need any discounts having a down-payment. More over, the brand new settlement costs would be rolled into the mortgage and/or merchant get pay them. For variety of USDA financing, at least credit rating out-of 640 is needed, however some lenders get take on a good 620 get. However, let’s discover the differences between the fresh new guaranteed finance and you may lead USDA finance.

The new head USDA financing

Once the name means, these fund are given from the Institution out of Farming by itself, not from the a bank. An immediate USDA financing is sometimes required to the people that have very low income. Potential individuals do not earn much more than 50%-80% of the median income in the region. Therefore, anyone with a yearly money less than $forty,100 can sign up for you to definitely. Definitely, there are more limitations and disadvantages. If you’d like to sign up for instance that loan, you ought to reside in you to definitely domestic a while later which address is to become your top home.

Our home you buy should have a gross dining area out of less than dos,100000 sqft, inside the apparently great condition. Home which have a call at-surface pool are also excluded. This type of funds have a predetermined interest which is currently step 3.75% a year. Pay times are either 33 otherwise 38 years, depending on the applicant’s earnings peak.

The fresh new guaranteed USDA financing

Such mortgage is actually for individuals with quite high earnings, usually no more than 115% of your own area’s average money. Speaking of given by see loan providers. Due to the fact Department out-of Agriculture promises 90% of your loan amount, lenders face really low dangers, therefore to be able to undertake no downpayment getting a beneficial USDA-guaranteed financial.

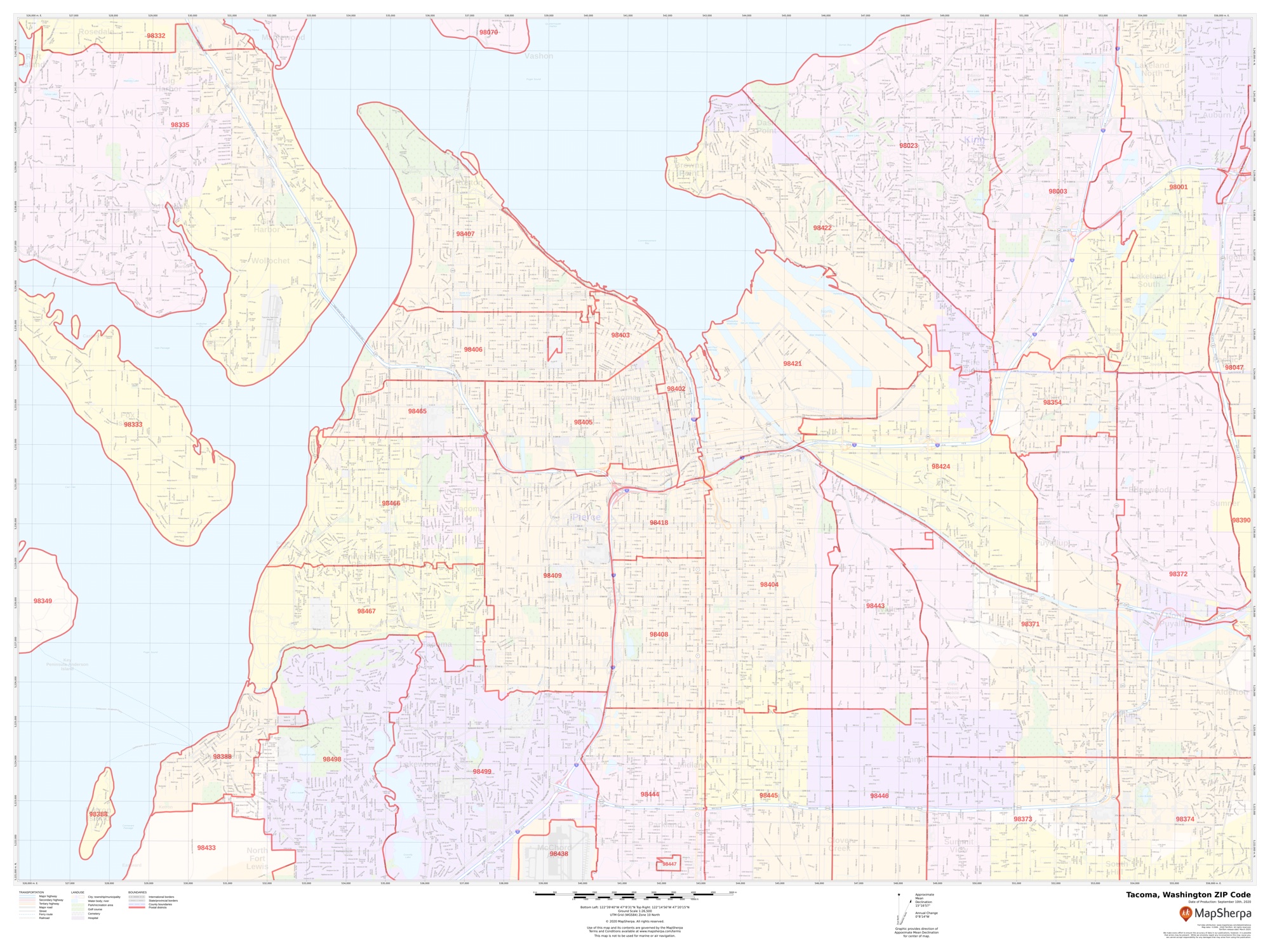

A significant step when selecting a house which have a USDA mortgage is the look processes. There are several geographical limitations positioned, nevertheless the Department out-of Farming made the newest look a great deal much easier by permitting one check if your house you love is within an area accepted getting USDA finance. not, the entire process can go quick and you may smooth if you discover a representative and determine the features you are looking for when you look at the property. A real estate agent will reveal a few homes www.cashadvanceamerica.net/loans/holiday-loans you to meet up with the USDA requirements along with your means. Then you certainly create your better selections finally buy the fresh new the one that becomes your property for the next ages.

USDA mortgage home reputation standards

While there is zero limit financing restrict for USDA guaranteed fund, you could find that your particular DTI (debt-to-money ratio) is really constraining one select characteristics with a particular market price. Loan providers must get to know both construction ratio plus the complete loans proportion, that’s why you will may see a few percentages, including % – the lowest one to.