Strategies for property Guarantee Financing to have a house Redesign

A property security mortgage allows you to tap into the home’s collateral to help you borrow cash. You could use the proceeds from a property security loan to pay for property renovate. You may also generate renovations, expected solutions, or improve worth of your property. Although not, there are a selection of various activities you need to know prior to taking out property security mortgage to pay for home improvements.

Key Takeaways

- Household guarantee money are fixed, so you know how far you will have to spend every week.

- You’re capable of getting an income tax deduction on appeal by firmly taking out a loan in order to renovate your residence.

- Particular home building work methods, like cooking area renovations, are more inclined to increase the property value your residence.

Just how Renovations Having a house Equity Financing Works

A house guarantee loan are secured by your house. Put another way, your residence functions as guarantee into loan. When you find yourself taking out property collateral loan, you ought Delta loans to find the best bank and you will pricing which you is also. Your own borrowing and home worthy of often apply at the interest and you can simply how much you could potentially pull out.

Go shopping for a loan provider

First favor a loan provider for your home collateral loan, labeled as an extra home loan. You can take into account the bank you to retains the original financial, otherwise number 1 home loan, for your home. In addition, you may want to ask family relations and you will household members to have guidance.

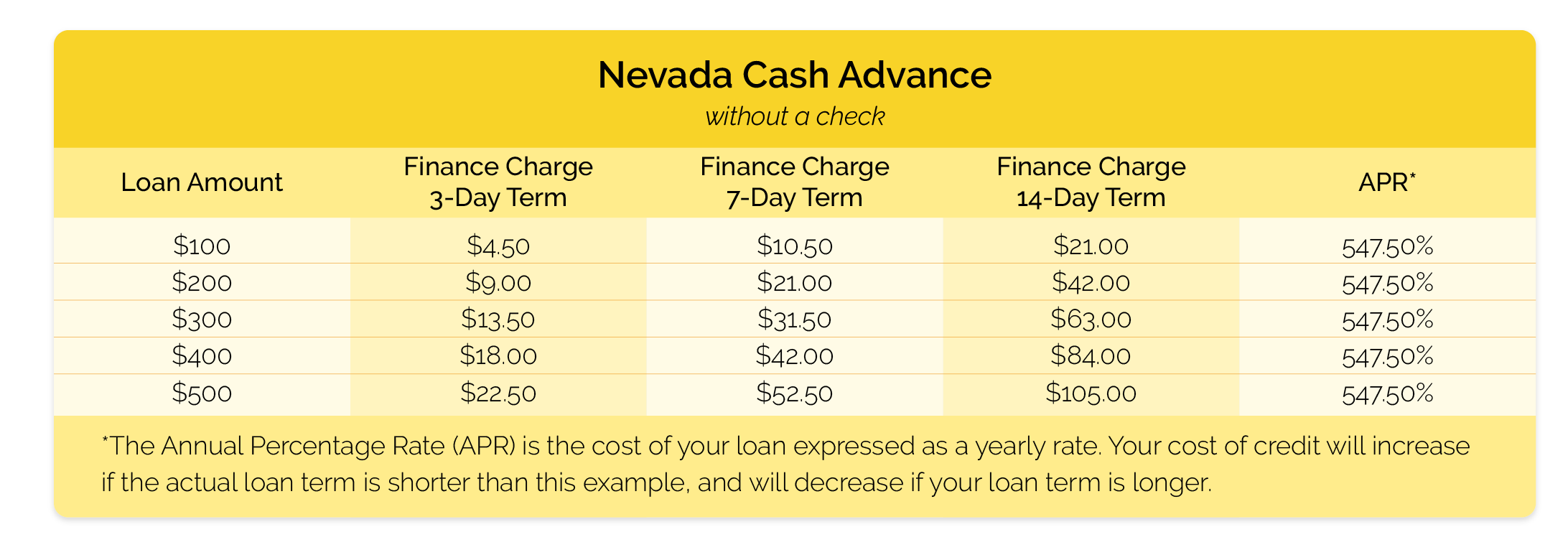

While you are looking at lenders, seriously consider the fresh new regards to the mortgage, such as the apr (APR) per lender even offers and people prepayment punishment it might costs if the you only pay off of the financing early.

Look at the Borrowing

Before you decide into the a loan provider, look at your credit file and credit history. Doing this allows you to location things otherwise errors that would be hauling off the borrowing.

For example, maybe a charge card payment turns up on the credit history as actually paid late if it really was paid back on time. Overall, later repayments or other negative suggestions stay on your credit score to possess seven ages. When the a credit bureau identifies your own fee is actually incorrectly indexed as the being late, the brand new later payment is meant to come-off from your borrowing from the bank declaration. Removal of the late commission you’ll enhance your credit rating, which can lead to better financing conditions.

Fill out an application

After you’ve picked a loan provider and you can featured their credit, you may be prepared to sign up for a property equity mortgage. These days, of numerous lenders allows you to use on the web.

When you find yourself doing the application form, you will end up inquired about the house you possess, your revenue, their costs, or other financial info that can help loan providers pick whether or not to approve the job. You’ll need to promote loan providers having data files for example W-dos versions, spend stubs, a duplicate out of a photograph ID, and you will proof home insurance.

- A credit history that meets the brand new lender’s standards; the better your credit score try, the more likely it is that you could secure a diminished Apr.

- At the least 20% guarantee in your home, that is dependent on what’s known as the mortgage-to-well worth proportion; domestic security is the matter your home is worth without having the count you will still owe in your no. 1 financial.

- A financial obligation-to-earnings proportion that’s 43% otherwise faster; it proportion is determined if you take all of your current monthly financial obligation repayments and you will isolating that count by your disgusting monthly income.

- Proof your capability and work out loan costs

If your application is approved and also you close into mortgage, the financial institution often generally speaking leave you a lump sum payment of cash that it will request you to repay over a-flat time.