What kind of Financial Do i need to Rating That have USAA?

USAA Home loan is the mortgage office away from USAA Lender, a financial institution priilies. USAA Mortgage even offers Virtual assistant financing, old-fashioned mortgages, jumbo finance and you can a traditional real estate loan option for individuals with about a step 3% off money.

USAA Financial will bring an entire directory of lending products and you may features such as auto, assets and you may term life insurance, banking, assets, old-age, home loan and you will fund. Just be an associate for taking advantage of every its loans in Riverside characteristics. Become eligible for new totally free membership, you really must be an energetic associate or veteran of your You.S. army otherwise cadets and midshipmen, or their families.

The bank, that’s headquartered into the San Antonio, is were only available in 1922 when 25 Armed forces officers decided to guarantee for each other’s auto. USAA keeps about 34,000 teams whom serve several.8 billion people.

Does USAA Work in My Area?

USAA originates financing in most fifty states. The bank have real locations in only 7 towns across the country. Financial representatives perform all the team on cellular phone an internet-based.

USAA does not have any equally as of numerous loan selection among the major five banks, instance Wells Fargo or Pursue, but you’ll however discover a number of options, including:

Veteran’s Issues (VA) loan: Becoming eligible for that it mortgage, you ought to meet among the you’ll standards plus providing 90 upright months within the wartime otherwise providing 181 upright months during the peacetime or higher than simply half a dozen decades from the National Shield or supplies. You may also meet the requirements if you find yourself the newest lover of an armed forces representative whom passed away out-of a support-relevant disability or in step.

Virtual assistant funds is actually supported by brand new Department from Pros Activities and you will feature a host of experts and zero down payment requisite, no individual mortgage insurance, the capacity to fund brand new money fee and you may a diminished money payment that have 5% advance payment. Veterans is actually exempt on resource fee if they’re acquiring impairment compensation. USAA specializes in these types of financing as its affiliate feet tends to be qualified to receive Virtual assistant money. Select from fixed-speed terms of 29, 20, 15 or a decade otherwise a 5/step 1 adjustable rate mortgage (ARM).

Jumbo loan: If you would like buy property you to definitely exceeds $548,250, you will need to apply for an effective jumbo loan. The phrase jumbo reveals that the price is actually over the regulators-set conventional financing constraints. Va jumbo finance require twenty-five% down payment and you will are in 31-season terms and conditions (fixed rates or 5/step one Sleeve). Antique jumbo finance are available in 29- otherwise 15-12 months words and require a 20% down-payment. USAA money mortgage brokers up to $step 3 mil.

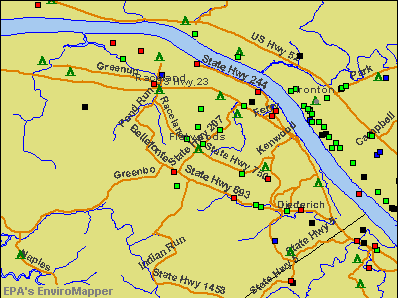

Countries Prepared by USAA

Traditional mortgage: Speaking of low-government-supported funds that adhere to the borrowed funds limitations set because of the Freddie Mac and you can Federal national mortgage association. USAA also offers repaired-price conventional financing. The speed stays the same during the course of this mortgage, which means that your monthly installments also continue to be steady. Homebuyers whom propose to stand installed their new residential property for the latest long term could possibly get see the fresh precision from a fixed-price loan and can even notice it easier to budget for costs that do not changes. Because of its straightforward and you may secure character, this loan is quite prominent. USAA also offers repaired-price conventional funds simply regarding pursuing the words: 31 season, 20 12 months, 15 12 months otherwise 10 season.

Conventional 97 mortgage: It mortgage try aimed toward very first-time homebuyers and can simply be useful a house one may be the top residence. The product is offered as the a thirty-year loan and needs merely step three% deposit that is followed closely by an appartment rate of interest, so buyers gets consistent monthly premiums. The lender will pay the private financial insurance needed for it loan (as a result of the low-down payment), however the pricing are enacted to you that have large interest levels than a conventional loan.