How exactly to be eligible for an enthusiastic FHA loan in the Virginia

Article Notice: The message for the post lies in the newest author’s views and you will pointers by yourself. May possibly not was indeed analyzed, accredited or else supported by any one of our very own system people.

For some consumers, purchasing a house with a mortgage backed by new Government Housing Management (FHA), called an FHA mortgage, tends to make homeownership far easier and more sensible. Such loans basically render lower down fee and you can credit score criteria so you can borrowers who be considered.

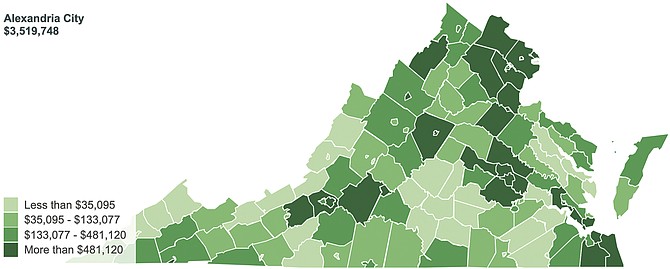

The latest FHA financing maximum to possess an individual-family home from inside the Virginia is becoming ranging from $420,680 and $970,800, according to the state. The reduced limitation relates to less expensive rural elements, while people looking house in the region on north the main condition close Arizona, D.C can get qualify for large limitations.

How was FHA mortgage limits calculated?

New You.S. Company from Property and you can Urban Creativity (HUD) establishes restrictions yearly how much of an excellent house’s cost this new FHA was ready to insure in almost any condition about You.S. These types of constraints depend on brand new conforming mortgage constraints which come which have conventional mortgage loans.

FHA money have both a great floor and you will a great ceiling. A floor ‘s the prominent financial the brand new agencies often ensure in most of the You.S.; it’s computed since the 65% of conforming mortgage restrict. The latest roof applies merely to higher-prices section that is determined just like the 150% of your restriction. In most of the country, brand new FHA mortgage restrict usually fall approximately the ground and you may new threshold, dependent on casing cost and you may structure costs in this urban area. Home prices became 18% regarding 2021 so you’re able to 2022, so limits both for conforming and you may FHA loans went upwards just like the really payday loans Jasper no credit check.

FHA finance usually are alot more forgiving than traditional funds if it pertains to fico scores and you may down payment number, so they really bring the opportunity to buy property smaller and you will with less money. However, there are certain FHA mortgage standards. Should this be your first date to invest in a home, you can qualify for significantly more assistance with among Virginia’s first-big date homebuyer software. They give you programmes to support the brand new borrowing from the bank techniques too once the money for example basic-time homebuyer income tax loans and you can advance payment assistance.

So you’re able to qualify for an FHA loan, you will have to borrow within the financing limitation where you happen to live and possess meet up with the after the criteria:

- A credit score out-of five hundred or higher. So you’re able to remove a keen FHA mortgage, consumers should have a credit rating with a minimum of five hundred. Which have a traditional financial, the minimum score try 620.

- An advance payment off step 3.5% or more. If for example the credit score was at minimum 580, you can even qualify for an effective 3.5% down-payment. With less credit score, five-hundred in order to 579, you’ll want to make a great ten% advance payment.

- Financial insurance rates. Extremely FHA financing wanted borrowers to expend one another an initial mortgage top (UFMIP) and an annual financial cost (MIP). The fresh UFMIP is actually 1.75% of total loan amount and certainly will be rolling to your mortgage. New MIP range out of 0.45% to at least one.05% of loan which can be dispersed between 12 monthly payments that you’ll fundamentally owe into the longevity of the loan.

- A loans-to-income (DTI) proportion regarding 43% otherwise less. Usually, FHA mortgage consumers cannot has actually a DTI that exceeds 43%, although some lenders support conditions.

- Family must be a first house. Consumers have to use the family because their number one quarters for at least 12 months shortly after buy. You simply can’t have fun with a keen FHA financing to shop for a moment home otherwise money spent, except if it’s an excellent multifamily property therefore want to live in one of several gadgets.

- An FHA household assessment. The brand new FHA features its own guidelines to have appraising a property, regardless of the house’s purchase price and/or down-payment amount.

To shop for an excellent multifamily assets which have an FHA loan

You can get just one-house that have an enthusiastic FHA mortgage as well as good multifamily house or apartment with 2 to 4 tools so long as you real time within the gadgets for around 12 months shortly after buy. Predict a comparable advance payment conditions, which have qualified people eligible to lay merely step three.5% off. An extra work for: If your plans are staying in one of the devices to possess 1 year, you may be able to utilize your own questioned rent to help you be eligible for the mortgage.

FHA loan providers into the Virginia

If you are searching having an FHA loan when you look at the Virginia, here are 7 well liked loan providers. Click on their brands to read through the full opinion.